Remember the Office Office, the Pankaj Kapur starrer magnum opus sitcom, aired on SAB TV in 2001?

In every episode, he’d visit a government office for his work, which as a result would turn out more pathetic than he’d have even anticipated! Amidst the spotless portrayal by Mr. Kapur, we had always grabbed some good dinner table laughs.

The sitcom was written on the premises of a pre-smartphone era in the early 2000s’ and hasn’t failed to have an extension of its footsteps even to this modern world, where technologies & efficiencies are the everyday talks of the town.

Knock! Knock!! Cut to the Present, it’s 2023!

Here I’m standing in a cluttered Office Space, which people fondly refer to as banks, trying to figure out who could resolve my plea!

In the era of the digital economy, only a dejected customer would land at a place like this, when some of the banking activities can’t be addressed online, for reasons known only to God!

“Good Morning, Madam! I need to activate my card.” I proceeded with showing the text SMS received from the bank to the lady at the counter.

“Ahh…!” she exclaimed with a blank facial expression, possibly wondering, why I’ve even come on a scorching Saturday morning!

“Can this be done here, Mishra Ji?” She yelled at the staff on the side table!

Mishra Ji, in the mid of examining the KYC document of a customer, “Yeah, Madam! The policy got an update recently, and the customer needs a bank visit for this purpose!”

It took her a few more minutes to practice something mysterious on her monitor screen while breaking the silence with “Show me your ID Proof”. I presented it without any delay & to add to my surprise, I was pushed to visit Mishra Ji’s table!

Well! Mishra Ji has got the ultimate chill while taking my case & looking at the lady again to probe if he really has to deal with all this! The relay race continued soon, just after a few seconds of examining my documents!

“Sir! Please meet that lady at that corner, who deals with this. I’ve initiated it from my side, she should be able to complete it”

Finally, the baton rested on the hand of Minakshi Ji, who didn’t take much longer to tell me, “It seems like, your card is blocked” and she was about to suggest me to visit another (4th in this case) person. I clearly mentioned her that, I had already been referred by two more persons here & she was the 3rd one!

I wasn’t there for any athletic race in the compound, I guess!

“Ohh!! Mishra Ji referred for this case! Wait a moment!” She responded.

The drama continued for a while and finally, she was able to figure out her core competency for which she was hired and addressed the issue!

But Bro! This is how Banks work. Don’t you know that!

Though it might appear like a simple case of a demanding customer, it reminds me how snail-paced and erratic the banking system even today is!

The single window by definition is a system where all facilities are available in one place.

I was pondering, what’s the point then, if it’s taking 3 human resources to figure out a simple task! The former co-founder and MD of the Indian fintech company BharatPe, Mr. Ashneer Grover has commented on a similar scenario:

As a customer, while visiting a financial institution, where someone keeps faith with the life’s earnings, it’s obvious to expect the highest quality experience. But, amidst all the adaption to digital literacy, you’ll find banks miserably struggling to keep their workforces relevant!

It appears like banks at times push you to visit the branch just to make you realize, they also exist somewhere around the street!

Even large public sector banks' mobile apps fail to serve at frequent occasions! You’ll need a galactic intelligence to figure out what even they do with all our money, and all the resources at their helm!

The Case of Inefficient Workforce

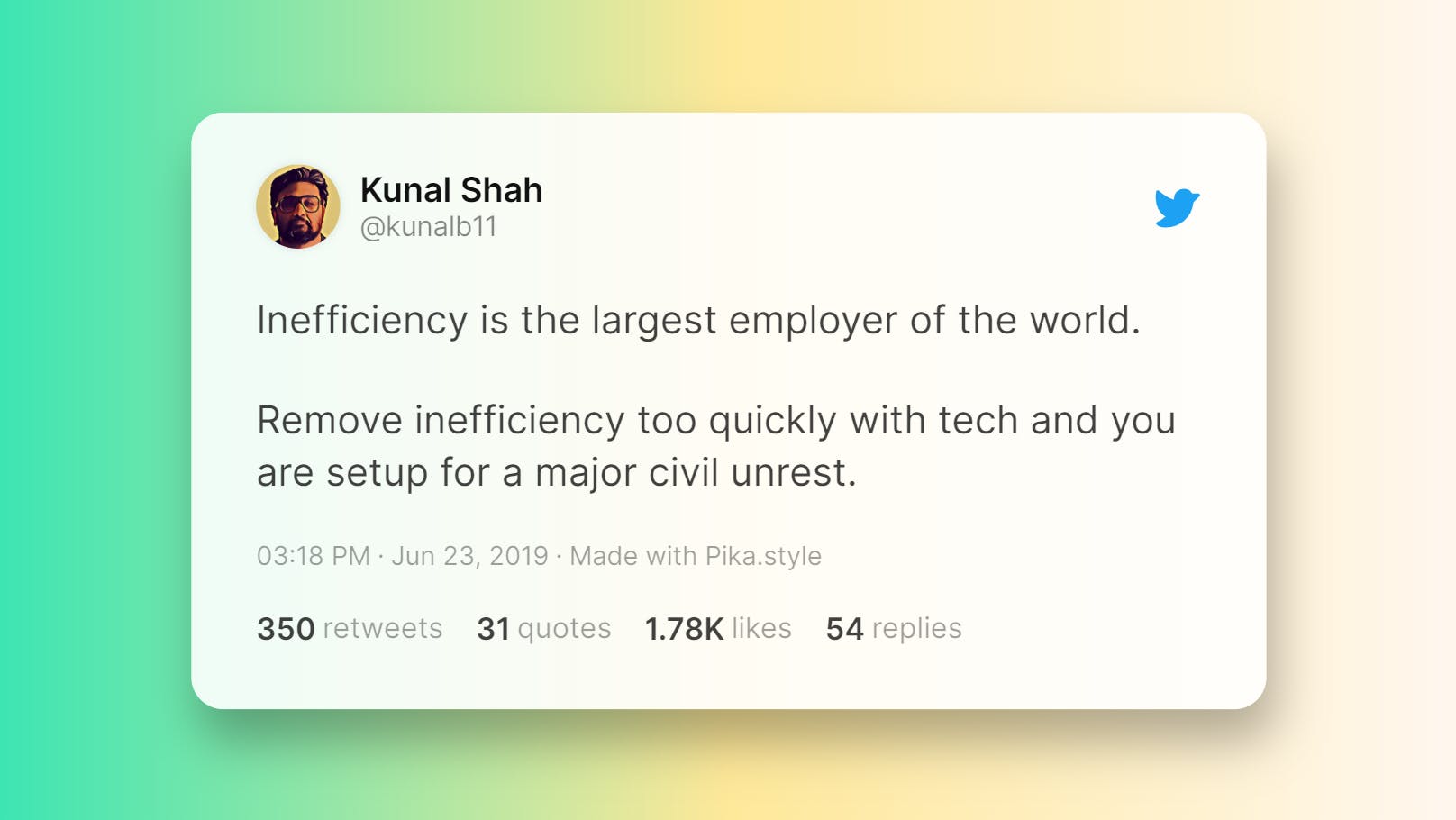

The Entrepreneur Ecosystem star Kunal Shah (Founder, CRED) explains it well:

What could be the classic case they could hold in defense, is it the knowledge? Absolutely Not! It’s a Central bank regulated environment, with hardly any scope to think beyond the line.

If you would list out the collective financial wisdom*(based on an exhaustive list of repeated questions they encounter in a month) of those 3 human beings and feed that to a database & make it function as a *chatbot with the power to follow instruction, their jobs might not even exist at the first place!

Banks need to move on from their slow-lethargic way of functioning. Being glued to a monitor screen and actually solving customer problems are two separate realities.

Their popular games of Come on next Monday or the overrated lunch breaks make me have pity on the masses, who accept the things they’re given without having the audacity even to ask for a good service against their money!

What an unfortunate scenario to witness contrary to the argument that the Customer is King!

Just imagine the conditions of such institutions, where silly things would drag to 3–4 persons, then think about the situations of the folks who’ve to access other critical services from banks like loans and financial assistance.

When a common person is going out at these places, she’s at the mercy of God, literally! This appears as a classic case of the wastage of human efforts, where less valuable tasks are getting entertained & those eventually add up to the systematic failures of an institution.

Neobank culture, which has started having its footsteps in India, might be the way of the future with the complete digital setup, where a large sector of people who value their time won’t have to deal with petty issues in person.

P.S:

In the end, I wanna clarify, that I don’t generalize here. There exists a group of hardworking elite performers in every professional calling.

This needs to be transformed with time, because the Banks need to win, to ensure a robust economy.